It’s a busy time in mortgage finance. Another strong quarter is in the books with production volume and margins at all-time highs.

Quicken, Caliber, United Wholesale Mortgage, Loan Depot, Amerihome, Guaranteed Rate, and Guild are all looking to go public.

Funding costs and yields have dropped and credit spreads have tightened close to pre-crisis levels. There’s plenty of cash in the system looking for yield. Massive prepays from Fed cash infusions, MBS purchase program, and lowering of interest rates have returned principal back to investors who need to reinvest and put their cash back to work. Lenders are fighting over operational resources in order to handle and process all the production volume.

Scratch & Dent

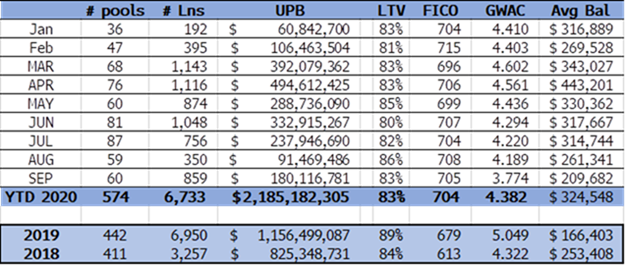

With record production volume, and everyone working remotely, there continues to be a consistent flow of scratch and dent paper in the market from originators and aggregators. The market has made big strides with market prices for this sector rebounding to levels that some investors consider “rich.” Pricing hasn’t returned to pre-COVID, over-leveraged prices, but they’re back to a trading range of upper 80s to mid-90s for product with minor flaws and market LTVs. There has been a flood of small pools and single loan trades across the credit spectrum at more attractive yields. Larger pools are trading more aggressively as investors are “paying up” for the opportunity to put larger amounts of capital to work. RAMS 107097 ($28.4mm), RAMS 107071 ($55.8mm), RAMS 106915 ($33mm), and RAMS 107085 ($15mm) all traded in the low to mid 90s for a wide range of credit and performance. There continues to be a mix of forbearance and delinquent loans in these pools (on average about 20% to 30% of pool balance). Forbearance loans are trading approximately 3 to 5 points back of similar loans without forbearance. The table below is a summary by month of S&D loans marketed in 2020 by RAMS vs the previous two years.

The new headline this week is the beginning of Agency put backs and repurchases. Fannie Mae has started contacting lenders and making repurchase demands. Apparently, Fannie Mae is casting a wider net to identify loans where a borrower has contacted the originators or servicer. This includes loans where a borrower only made contact and didn’t necessarily request a forbearance plan or claim any hardship. A borrower contacting an originator or servicer to find out their options or gain more information on the rules relating to forbearance plans, may be deemed ineligible and put-back to the originator.

May the hand to hand combat begin!

Lenders are looking at their agency contract for the definition of what qualifies for a forbearance plan versus the new definition Fannie Mae has now put in front of them. Servicing notes are being pulled and reviewed, but this action may not lead to a resolution. In addition, it looks like repurchase will be the only option vs the 5 to 7-point hit levied for those loans in forbearance earlier in the year. We are monitoring this closely as we expect lenders to get more aggressive in pushing back on these repurchase demands.

Non-QM

Agency eligible loans are the primary focus for most lenders today. There is huge demand from borrowers to refinance into lower rate loans as well as a brisk purchase market. Margins are very attractive in the agency space, and scars are still fresh from the recent non-agency market shut down, but the Non-QM machine is back, and there is strong demand for new issue securities. Recent third quarter deals included ~6% coupon, ~720 FICO, and ~75% LTV. Non-QM production is on the rise, but not at the pace we saw prior to the pandemic. New production loans are trading in the 102.50 – 103.50 price range. Seasoned loans originated prior to pandemic, such as RAMS 107121 $13.3mm, are trading in the mid to upper 90s.

We have launched the Non-QM portfolio and warehouse financing one-stop bulk purchase program, mentioned in the last update. This program does not rely on the private label securitization market, shielding sellers from the volatility that has occurred in the recent past. Please contact us if you’re interested in learning more.

Jumbo

New production, 30-year, fixed rate, jumbos are trading well with solid demand from bank portfolio and private label security issuers. This new production is trading 1.50 – 2 points back of interpolated TBAs. Jumbo ARM production is light due to low fixed rates and the duration trade-off is muted by comparable 15 and 30-year rates. There have been very few bulk seasoned ARM pools out in the market. There is strong demand for this product, but bank sellers are flush with deposits and are challenged to find more attractive investments. RAMS 107072 $48mm, a Small Balance Commercial (mixed use &multi-family) portfolio, came with a very strong credit profile, and 6% coupon. Bids came in at 102. We’ll be marketing a ~$75mm Jumbo ARM pool later this month.

Government Loans & EBOs

Due to the pandemic, and overall economy, FHA and VA loan delinquencies have been on the rise and many lenders are contemplating how to handle the onslaught of borrowers coming out of forbearance. The high touch nature of these delinquent loans, and strict servicing rules, create higher costs, and, we believe, are better served in the hands of special servicers. Ginnie Mae issuers and servicers have been buying these loans out of pools using financing lines to stop the cash bleed of advancing into GNMA securities. The recent July pooling restriction issued by Ginnie Mae requiring borrowers to make 6 consecutive timely payments prior to re-issuance will limit the number of loans issuers can redeliver. With all the state and federal intervention in evictions and foreclosures who knows how long some of this paper will be stuck in limbo as lenders bear additional financing and servicing costs. Lenders could be left owning and servicing more troubled loans for a longer duration than expected followed by selling loans into a much less favorable market.

RAMS 107007 ($22mm) and RAMS 106765 ($23mm) traded in the low to mid 90s.

NPL & RPLs

There are high expectations for additional supply to come to market in the near-term due to economic uncertainty and the ongoing pandemic. We’ve heard there are multiple firms raising money for opportunity funds in anticipation of this additional supply. Investor returns on non-performing loans (NPLs) are based on projected percentage of re-performance, housing appreciation, and timelines to foreclosure sale. Home price appreciation has been on the rise across the country, but the state and federal eviction and foreclosure moratoriums have extended timelines. That said, pricing and demand have remained firm. Smaller pools continue to trade behind the larger pools by between 5 and 8 points.

Last week, FHLMC sold 4 pools of mostly re-defaulted, previously modified, loans totaling nearly $500mm. The pools were stratified primarily by LTV. Market color is pools 1, 2, and 3 traded to one buyer in the ~6% yield area, and the 4thpool with >100% LTVs traded in the 10% yield area.

Fannie Mae had $2.8BB of RPLs out for bid Tuesday and loans traded at very strong levels. We’re expecting more details early next week. RPLs remain very well bid with prices in the range of 90s to par plus, with yields inside 4%. Seasoned RPLs are trading higher as buyers can evaluate, and project, future borrower performance based on a longer track record, including borrower payments at a time when borrowers were offered forbearance.

We’ve recently traded several pre-COVID Bridge and Non-QM NPLs at higher prices than performing loans. This is due primarily to very high default interest rates (~24%) coupled with low LTV’s. We recommend originators investigate adding to their promissory note’s language related to a stepped-up coupon triggered by nonpayment as price protection against potential future defaults.

We have a handful of super jumbo NPLs and REOs in NY, CA and FL available for sale and properties ranging in value between $3mm to $17.5mm. Delinquent borrowers in this space tend to be very “creative” in their ability to avoid payments and foreclosure. One of these loans hasn’t made a payment for 11 years. One interested buyer we talked with is planning to resolve jumbo NPLs using an approach outside of the foreclosure and legal process.

CRA Inquiry

We have a large supply of agency eligible CRA loans nationwide. If you’re in need of CRA credits (investment, lending or service), this may be your last chance to get your HUD numbers in line for 2020!