Whole Loan Evaluation Services

RAMS knows the whole loan mortgage market.

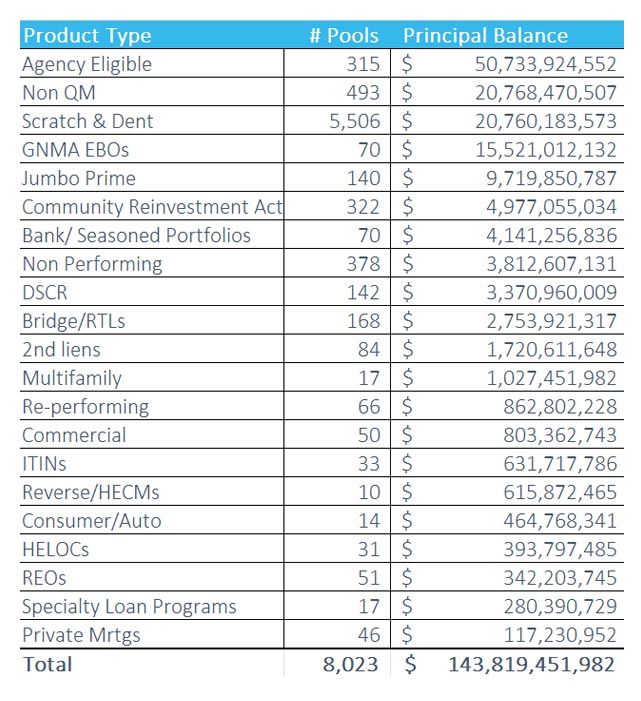

Accurate valuation starts with knowing where loans trade. At RAMS, we know the products, flows, and prices in every corner of the whole loan market. We know the sellers and the buyers. RAMS Mortgage Capital is one of the most successful whole loan broker-dealers in the U.S. We have more than 800 active clients trading billions of dollars of whole loan mortgages in every sector of the market, and a proprietary trade database with market prices on billions of dollars in loans. The RAMS team is made up of institutional mortgage experts who have worked across the industry – at commercial banks, originators, investment banks, institutional investors, and major accounting firms. Drawing on this experience (over 150 cumulative years in senior management alone), we have designed a valuation and reporting process that meets the complex needs of firms in all areas of the mortgage business.

RAMS’ valuation process delivers state-of-the-art market data, analytics, and reporting.

Unparalleled Market Intelligence and Pricing Data

Trade driven market pricing is the foundation of RAMS’ valuation process. We do not rely on models alone.

RAMS trades significant volumes in every sector of the whole loan market. We know who’s buying and selling, and we know the most advantageous market or best execution buyer for every mortgage asset. RAMS active participation in the whole loan market is an essential advantage in valuing complex whole loan sectors, including:

- Scratch-and-dent

- Aged loans on warehouse lines

- GNMA Early buyouts (EBOs)

- Nonqualified mortgages (non-QM)

- Nonperforming, sub performing, and reperforming Community Reinvestment Act (CRA)

- Jumbo bulk and jumbo ARM

- Bridge and fix & flip

- Commercial and consumer loans

State-of-the-Art Analytics

RAMS’ valuation model is based on loan-level analysis using a discounted cash flow framework. Every loan is priced individually. Our state-of-the-art model projects borrower performance based on each loan’s characteristics and history. Our proprietary cash flow engine translates these detailed projections into monthly loan-level cash flows. We have the flexibility to model a wide range of market and economic scenarios. RAMS’ unmatched market intelligence ensures that the results align with current market pricing.

Loan-level analysis. RAMS’ proprietary model prices every loan individually. We project detailed cash flows for each loan based on sector, characteristics, and history. Our traders use their market knowledge to determine the appropriate yield or spread for each asset. Each loan’s price is the present value of projected future discounted cash flows. Final results are analyzed and screened for reasonableness in the context of current market pricing.

At the portfolio level, loan-level pricing and scenario analysis give clients a detailed picture of the contributors to value and risk. This is essential for risk assessment and for documenting portfolio valuation.

Cutting-edge model for projecting borrower performance and loan resolutions. RAMS’ next-generation loan performance model is built on a transition roll rate framework, which models each monthly loan payment individually. Transition rate modeling generates precise, granular projections of borrower behavior and loan dispositions that are more accurate than standard pool-level curves for prepayments, defaults, and loss severity. The RAMS’ model effectively projects the path of distressed credits from initial delinquency through liquidation. It is superior at capturing the complexity of nonperforming and reperforming loans, modifications, and loans in forbearance.

Model built on detailed historical loan-level data. Loan-level data permits greater modeling precision than pool-level data. We used billions of data points from 20+ years of history on more than 200 million loans. Our sources include agency and non-agency servicing data as well as loan-level historical data from Ginnie Mae, Fannie Mae, and Freddie Mac. The model was developed using non-parametric methods, which are more flexible than traditional linear regression and often better at fitting real-world data. Prepayments are projected using loan-level inputs, with sub-models for housing turnover and refinancing. This level of detail provides an advantage in analyzing credit-sensitive and resolution-sensitive assets often seen in the whole loan mortgage sector.

A single, integrated model to handle every loan. Cash flow from every loan is evaluated through one unified model. Performing and nonperforming, loans and MSRs, current loans and liquidations are all valued using the same framework.

Risk management is stronger when all assets are measured with the same yardstick. In our model, loan valuations rely on the same projections of borrower performance. One model seamlessly tracks the path of a nonperforming loan from initial delinquency through liquidation.

Proprietary loan-level cash flow engine. Our cash flow engine is designed for accuracy and granularity. We use a best-in-class mortgage rate model. Our loan-level methodology delivers more realistic timelines for distressed loan resolutions. Our loss severity projections incorporate details of expenses, liquidation timelines, and government and private mortgage insurance claims in addition to foreclosure sales.

For Ginnie Mae EBOs, our model tracks the cycle from delinquency to buyout to potential resecuritization and gives detailed projections for each stage of the process. It does the same for reperforming loans and loan modifications.

Flexible scenario analysis. Our model can project asset performance in a wide range of scenarios, including changes to interest rates, prepayments, home price appreciation, credit performance, foreclosures, servicer behavior, and liquidation timelines. It can also analyze the impact of GSE and HUD policy changes and mandated forbearance periods.

RAMS Valuation Analytics: Key Elements

- Loan-level evaluation

- State-of-the-art transition roll rate framework for projecting borrower performance

- Single, integrated model for all loan products

- Flexible scenario analysis

- Unparalleled market intelligence

Flexible, Comprehensive Reporting

RAMS has the reporting flexibility to meet the needs of every user in your organization, from analysts and auditors to executive management. We produce executive-level summaries as well as detailed reports with scenario analysis for credit performance, home price appreciation, prepayments, and changes in interest rates. We provide complete historical return attribution analysis that shows how and why prices change over time. Our reports break out value and risk measures across key stratification characteristics to illuminate the factors contributing to portfolio risk and reward.

RAMS Valuation Reporting Package

- Executive summary

- Market value and other key statistics by loan product and property type

- Portfolio return attribution

- Portfolio prepayment and default projections

- Portfolio cash flow and principal balance projections

- Stratifications: age, occupancy, purpose, FICO, LTV, rate, loan balance, term, state

- Sensitivity analysis: prepayments, defaults and loss severity, home prices, interest rates

- Scenario analysis: client designated, or RAMS guided assumptions/scenarios.

RAMS’ core philosophy is “no surprises.” We emphasize communication with clients at every stage. Our reports deliver unique, relevant, market insights, clearly presented, that help clients make better decisions about their portfolios.