We are halfway through 2021 and the 2nd quarter is now history. The world is forging ahead and trying to put the pandemic in the rearview mirror. Who isn’t planning a family vacation right now! Interest rates remain low and origination volumes remain strong, though pressures are rising. Refinances have slowed and margins are tightening. Many originators are already evaluating operation infrastructure and considering how they may need to reduce overhead and consolidate operations in a reduced refinance environment. Inflation concerns, fear of rising rates, and treasury tapering are leading the headlines, but the 10yr treasury has rallied back to the low 1.30’s%. The U.S. economy is accelerating with the hottest housing market in memory. Funding costs near record lows have investors eager to put capital to work at historically low discount rates.

Buyers in the market have a voracious appetite for assets. There is simply more cash than assets to buy.

Non-Owner Occupied (NOO) | Investor Loans

The GSEs warned the market they were going to cap their purchases of non-owner-occupied investor loans and second home loans in order to lower their portfolio concentration below the current 10%. Originators widened their pricing to slow production to what the markets believed would be 7% cap. In the beginning of June 2021, Freddie Mac shocked the market by capping production at 6% starting July 1st. Then, Fannie Mae further stunned the market with their announcement of a 3% cap for certain originators, effective immediately. You would think such actions would cause a huge increase in available product for sale and a drop in price, right? No. Not only has the market absorbed the excess product, but spreads have actually tightened in this product class. Larger originators and street firms have been aggregating for Private Label Securities (“PLS”) with the announcement possibly boosting MSR values and IO multiples due to future refinance opportunities. But with higher pricing will this revert? Recent NOO PLS have traded 25 bps tighter than Jumbo PLS given the favorable convexity profile. We believe there is a reasonable chance that these GSE caps are removed under new FHFA leadership.

Prime Credit & Jumbo

Newly originated, Non-Agency Jumbo, 30-year fixed rate product continues to be well bid. PLS continues to dominate the marketplace and security prices and spreads remain tight. Structured deals are offering bond investors yield and duration options across the credit stack. Bank demand for 30-year fixed rate product on balance sheet is not as strong with the fear of higher interest rates and durations extending. 15-year fixed and ARM demand remains very strong, but there continues to be limited production available as low rate 30-year loans dominate the market. 30-year fixed rate product is trading ~3% back of interpolated agency price, or just inside 3% bond equivalent yield. FNMA 2% are down 37.5bps in price from early May, and jumbo coupons are ~25bps lower with 3.25% pricing at mid-101.

Non-QM

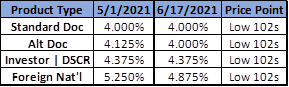

Non-QM paper continues its pace of strong investor demand as supply has picked up. There were 4 PLS deals in the market in the last week of June. With agency refinances slowing, originators have started to re-focus on specialty loans and alternative products, such as Non-QM. The Non-QM to Jumbo spread has tightened as depicted in the table below:

We’ve been helping originators find investors for specialty loans, including ITINs, IRA loans, doctor programs, seller financed HECMs, and GNMA 203k’s.

GNMA Early Buyouts (EBOs)

The pandemic threw the economy into a tailspin with asset managers seeing headlines of foreclosure moratoriums, forbearance, and record delinquencies, as an opportunity to raise capital and invest in troubled assets thereby increasing assets under management. However, the market did not cooperate, and we have not seen the anticipated wave of distressed assets. The rebound in the economy reduced delinquencies (or at least “deferred” them), and the lack of supply of conventional non-performing loans has created a food fight for any available assets in the marketplace. We have seen delinquent FHA loans trade as high as 102%, plus the refund to Seller of all interest advances, escrow advances, and recoverable corporate advances and VA loans trade at par, plus refund of all advances. The FHA and VA pricing is about 4 points and 7 points higher, respectively, than pricing at the beginning of the year.

We have been evaluating an average of $1 billion in FHA, VA, USDA, and RHS loans per week over the last 3 months. We continue to encourage servicers and investors in these loans to get a RAMS EBO Analysis. An EBO Analysis will identify “Positive Variance” loans, or loans where the sale price exceeds the total EBO Buyout Cost, which includes UPV, interest advance, escrow advance, and recoverable corporate advance. Then, on all other loans, the EBO Analysis will determine the shortfall between the EBO Buyout Cost and sale price, which is the amount the Seller must invest in order to complete an EBO Buyout transaction.

We have several market observations to share.

- VA pricing is creeping up toward FHA pricing. Even though VA loans price less than FHA loans, in general, due primarily to the difference in the insurance guaranty, the pricing is getting closer. The primary driver of the increase in VA pricing is the projected re-performance or re-pooling assumption. We have seen prices where Buyers are assuming 85% re-performance or re-pooling. When such a high percentage is applied, there is less impact to pricing on the 15% of loans assumed to either payoff or exit through liquidation. Also, as stated below, extreme competition for FHA pools is pushing some buyers toward VA pools and we have seen about a 7-point price increase since the beginning of the year.

- Highest bids for FHA have evolved to include refunding all advances, not just escrow advances. As competition for FHA pools of more than $100mm increases, most top bids include the refund of 100% of all advances. We anticipate due diligence of advances will become more detailed now that buyers are refunding 100%. Sellers, especially those who utilize third-party sub-servicers, are hoping their sub-servicer has done a good job of documenting advances for ease of review. We will be monitoring to see if there are adjustments to purchase prices post due diligence.

- Future risk/reward sharing transactions. We have seen some Sellers opt for sales involving future sharing of risks and rewards from EBOs. Risks include refunding to Buyer any loss over the remaining life of the subject loans, including FHA interest shortfall due to the variance between the actual interest rate and the FHA Debenture Rate. Reward sharing is where the Seller receives a portion of the profit between par and the GNMA securities price less costs of sale on loans re-pooled in the future. Sellers interested in this type of structure should make sure they can achieve sale treatment if that is a goal.

Even though it was announced that the foreclosure moratorium extension until July 31st is the last one (see detail below), we still do not know how quickly the courts will proceed on foreclosures. A never-ending foreclosure delay could get challenged in court, and perhaps make it to the US Supreme Court, if the validity of the mortgage contract is in question.

Foreclosure and Eviction Moratorium

The following was copied from the White House Briefing Room Statement of June 24, 2021: In addition to the actions outlined to support tenants and landlords, today, the Biden-Harris Administration is also announcing efforts to support homeowners. Three federal agencies that back mortgages – the Department of Housing and Urban Development (HUD), Department of Veterans Affairs (VA), and Department of Agriculture (USDA) – will extend their respective foreclosure moratorium for one, final month, until July 31, 2021. The Federal Housing Finance Agency (FHFA) will also announce that it has extended the foreclosure moratorium for mortgages backed by Fannie Mae and Freddie Mac until July 31, 2021. Once the moratoria end, HUD, VA, and USDA will take additional steps to prevent foreclosures on mortgages backed by those agencies until borrowers are reviewed for COVID-19 streamlined loss mitigation options that are affordable, while FHFA will continue to work with Fannie Mae and Freddie Mac to ensure that borrowers are evaluated for home retention solutions prior to any referral to foreclosure. In addition, HUD, VA, and USDA will also continue to allow homeowners who have not taken advantage of forbearance to date to enter into COVID-related forbearance through September 30, 2021, while homeowners with Fannie Mae or Freddie Mac-backed mortgages who have COVID-related hardships will also continue to be eligible for COVID-related forbearance. Finally, HUD, VA, and USDA will be announcing additional steps in July to offer borrowers payment reduction options that will enable more homeowners to stay in their homes.

It is important for the White House to signal an end to the foreclosure moratorium and eviction as of July 31, 2021. Assuming this is not extended for any reason, the timing of foreclosures and evictions will be determined by actions of individual states and municipalities. With the potential backlog of cases (we know there are still outstanding cases in New York from the mortgage crisis in 2008), we’ll see if the market can get a clear understanding regarding foreclosure and eviction timing. Currently, this is an educated guess for buyers.

On June 25th, Ginnie Mae announced the creation of a new pool type comprised of 40-year amortizing loans. These will be “custom” pools having a single loan and $25,000 minimum pool size. This will help liquidity and allow servicers to offer 40-year terms under modification agreements, thereby making payments lower for borrowers. Pools are expected to be issued in October. We have buyers looking for these loans.

Scratch & Dent

Same theme here with strong investor demand and prices slightly tighter. We’ve marketed more than 600 S&D portfolios year to date. This remains an attractive sector where an investor can pick up yield relative to other sectors. Of the $1.5BB marketed year to date, the weighted average characteristics were: 3.53% GWAC, 79% LTV and 11 months seasoned.

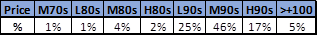

The table below shows percentage of S&D loans sold by price range in first 6 months of 2021 . As you can see, 88% have traded with a 9-handle price.

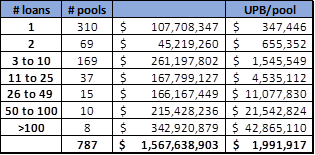

If we ballpark the average price at 96%, this models out to ~4.50% yield. With FNMA 3.5s @ 105-08, S&D pricing is a little more than 9 points back of TBA’s. While relative pricing is attractive, the hurdle for this strategy is size of trades. The table below reflects the number of loans and UPB per RAMS S&D offering this year. Over half the offerings were single loans.

We want to remind everyone to enjoy the summer. As Shakespeare once said, “Summer’s lease hath all too short a date.”