Scratch & Dent continues to be one of our most active sectors by number of offerings, so we thought both buyers and sellers would benefit from an in-depth look into the current structure of the market. Attracted by deep discounts, the availability of supply, and the lack of supply in other products, institutional investor interest increased dramatically in Scratch & Dent loans over the last year. Marketing close to $6bln of Scratch and Dent loans during this time, loss adjusted yields averaged 408bps over the 10yr treasury with prices hovering around 80%. The positive convexity of deeply discounted loans combined with the low dollar price limited the variability of returns from both a rate and credit perspective for investors. As we move into 2024, let’s take a look at what that may mean for the sector going forward.

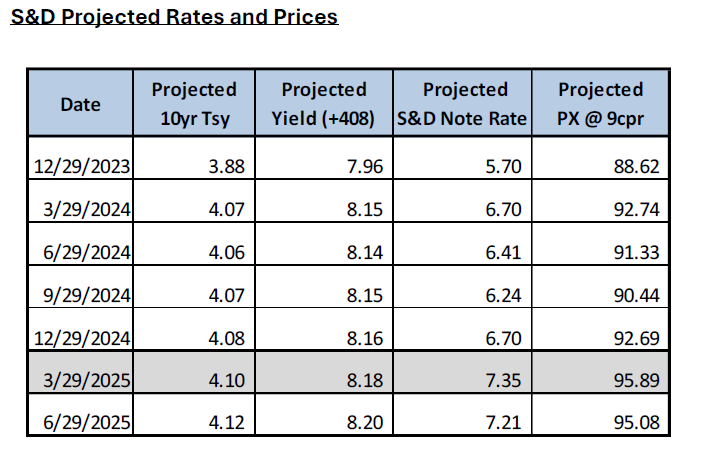

As we project what the S&D sector may look like, it’s important to realize that S&D loan note rates sold typically lag market rates on average by about 18 months. As rates rose throughout 2022 and 2023, this left a wider than typical spread between coupon and bid yields. The table below projects what S&D coupons may be available going forward based on the FHLMC 30yr survey rate with a 6- quarter lag while also projecting where investors will be bidding S&D assuming a fixed spread of 408bps over the 10yr treasury. The result is, by the end of Q1 2025, the spread between projected bid yield and S&D note rates compress to 83 bps with corresponding S&D pricing increasing into the mid-90s. This is simply due to higher production coupons making their way into S&D sales.

Conclusion:

For S&D buyers, be prepared for higher prices simply as a result of higher note rate loans coming to market in 2024. If buying loans in the 80s is a major part of your investment thesis, make sure to buy the lower note rate loans when you see them.

For S&D sellers, if you have low notes rate loans, now is a good time to sell into strong investor demand. The key drivers of price for deep out of the money note rate S&D loans is both a buyer’s CPR and yield assumption. Both are unlikely to change in the near term due to the flat forward curve and the out of the money note rates. Even in a rates down scenario, many of these assets won’t get the benefit of running faster speeds on discounted loans, so they typically underperform price expectations of sellers. Waiting to sell S&D only increases the opportunity cost of holding negative carry assets on the books while taking on more rate volatility risk that can be expensive to hedge. If you typically do not hedge your S&D position, the price action of the last few years should help persuade you.

Should you need any help knowing the value of your specific S&D portfolio or any other loan or MSR type, RAMS is offering whole loan mortgage value on services. We have built a database from the millions of bids observed in the past several years, across every type of mortgage imaginable (we even sold a butterfly farm loan last week!). The combination of our dataset, robust cash flow modeling and state of the art analytics allows us to provide a true mark to market price. Please call for more specifics. We hope this information helps you navigate the S&D sector in 2024 and beyond.