For most non-bank originators, finding liquidity for jumbo loans has been difficult since the onset of the pandemic. Recently, Mortgage News Daily reported the jumbo market share shrank from 12.2% in Q3 of 2023 to just 10.6% in Q4 with the full year 2023 contracting to 12.0% down from 17.8% in 2022. With jumbo 30-year fixed rates consistently higher than their agency counterparts, the jumbo sector is looking historically cheap on a loss adjusted yield basis but still not cheap enough to abstract new capital to the sector.

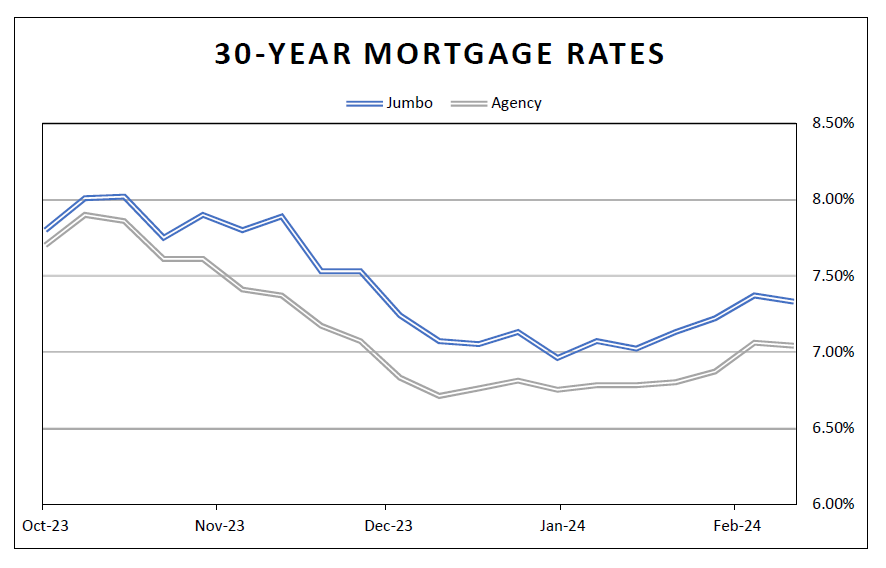

The chart below shows the Bankrate 30-year jumbo rate in blue and MBA’s weekly 30-year fixed rates in green over the last four months.

3 reasons why liquidity has waned:

- Limited liquidity provided by bank porfolios given recent capital, deposit, and balance sheet issues. The securitization bid now dominates execution which is typically wider than the portfolio bid.

- The inverted yield curve (high fed funds rates) means there is minimal to negative carry for buyers accumulating for a securitization exit. Typically, carry income provides a cushion for hedge costs and potential spread widening for the Investors. This is non-existent in the current market environment.

- Other non-agency alternative loan types, like non-QM and closed end seconds, are more attractive assets for investors to securitize. Both have higher note rates and higher larger retained credit tranches. Jumbo loans will lose out to these other products for new money manager investments into the mortgage space.

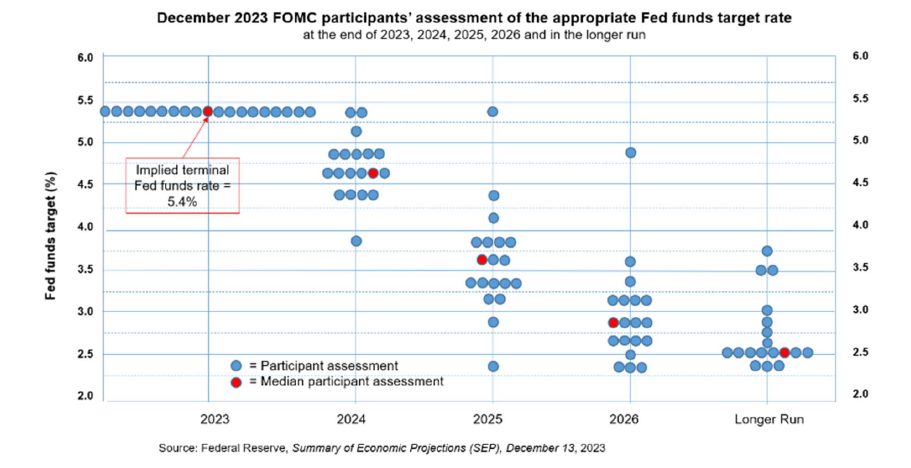

For jumbo loans to tighten back to note rates inside of agency, a few things need to happen. First, portfolio buyers need to emerge. With banks still largely on the sidelines, and many REITs unable to raise new capital due to share prices being below NAV, the market is looking for Insurance companies to fill the void. Insurance companies sold a record number of annuities in 2023, $360bln vs $311bln in 2022. Even with a modest allocation to mortgages, this could add much needed liquidity into the jumbo sector. Second, the treasury curve needs to go back to a positive slope. The Fed cung rates (assuming this happens in 2024) should have a positive impact on the securitization bid, bringing back positive carry into loan aggregation while also helping 2024 bank and REIT portfolio bids by healing balance sheets with higher portfolio asset prices. Given the projected Fed rate cuts (see the most recent dot plots below), this could happen towards the end of this year.

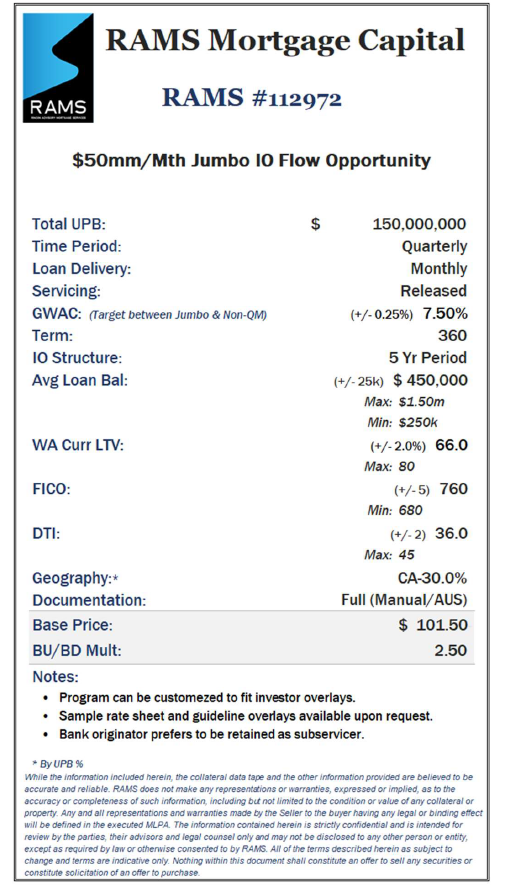

Filling the liquidity void with flow transactions.

Both buyers and sellers widely adopted forward flow transactions for non-QM loans in 2022 in the face of diminishing liquidity. We think forward flow transactions can help fill the liquidity void in the jumbo sector as well. From the originator perspective, locking in flow execution allows for the start-up of loan programs or expansion of existing programs while locking in consistent pricing. For investors, it enables them to secure volume that matches specific risk tolerances by loan type. Each flow transaction is custom tailored to match the originator’s volume and credit characteristics with the investor’s needs at both the loan and pool level. We have sellers across a wide array of product types including non-QM, jumbo, agency NOO and fix & flip. Below is one example of a current opportunity for prime jumbo IO loans. If you have interest in exploring flow transactions as either a buyer or seller, please contact your RAMS representative.