Congratulations! We have made it through another tumultuous year in the mortgage market. While 2023

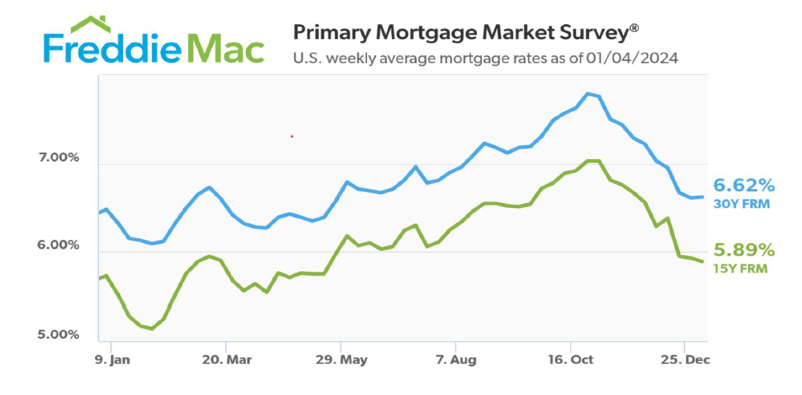

had its share of difficult moments, we are happy to see it end on a positive note with the trajectory of lower mortgage rates giving us all something to hope for – the prospect of higher volumes in 2024.

We have come a long way in the last 12 months to get to where we are today. Recall, we started 2023 with just about every economist predicting a 2023 recession. We lived through the early March – Silicon Valley, First Republic and Signature Bank failures while collectively holding our breath to see if more banks would go down spreading chaos into our space, as we endured 100bps of Fed Funds Rate increases the first half of the year to see the Fed pivot in Q4, leading to trending lower mortgage rates at year end.

Even with the potential trajectory of lower rates, we are starting 2024 with the same liquidity constraints we saw in 2023. Most notably, bank secondary market activity remains limited. Bank purchase volume for RAMS dropped by 65% from 2022 levels. Aggregator, bank, and warehouse bank consolidation within the mortgage space is creating a difficult operating environment for many smaller originators relying on larger firms for takeouts or financing.

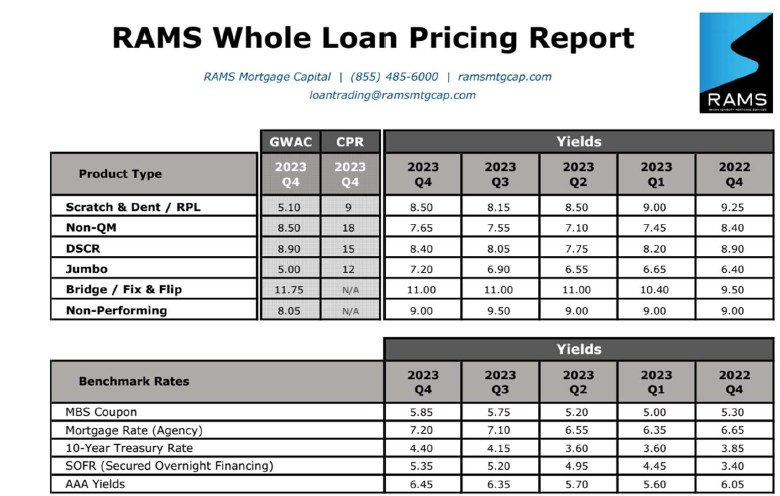

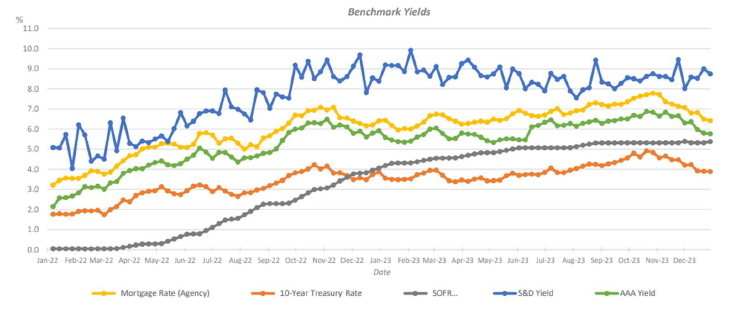

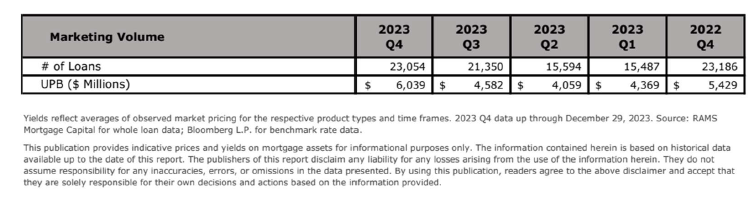

As we moved through 2023, what the market lost in bank portfolio liquidity, it picked up in credit focused private capital buyers. This is evidenced specifically in the S&D sector where loss adjusted yields tightened by 50 bps during 2023 while jumbos widened by 55 bps. Other more credit sensitive products outperformed as well with non-QM and DSCR outperforming jumbos by 35bps. The RAMS Whole Loan Pricing Report (see below) aggregates each quarter, across a myriad of loan types, tens of thousands of our bid observations. If you would like to be on the distribution list for this quarterly report, please contact your sales representative.

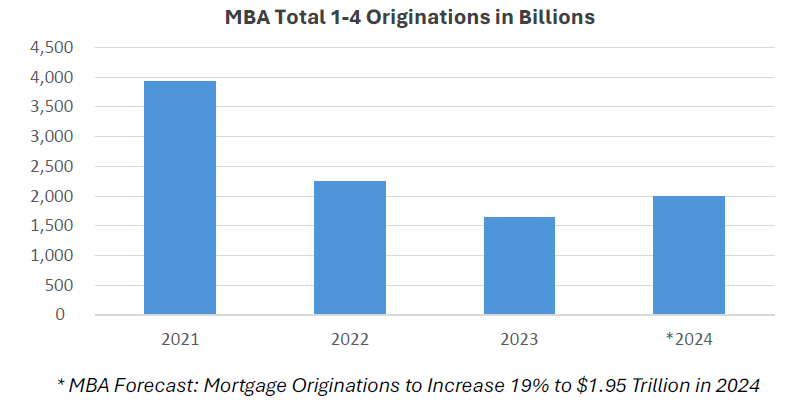

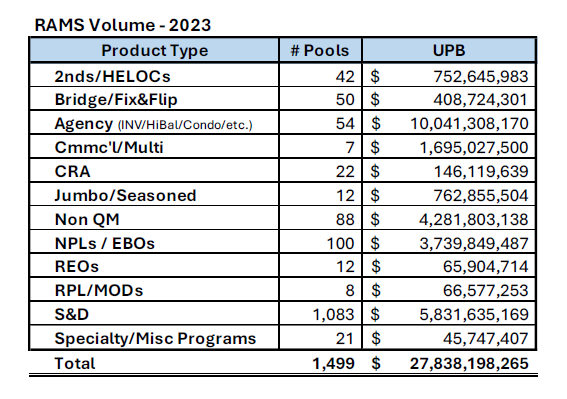

RAMS bid volume in 2023 was a robust 1,499 pools for $27.8 billion UPB despite total mortgage originations being down 27% from 2022 and 58% from 2021 levels. Details of our market volume are provided in the table below. The amount and variety of product types we trade in give us unique insight into current market dynamics and pricing. To that end, should you have any questions regarding where your specific loans would trade or need financial statement loan evaluations, RAMS offers whole loan mortgage valuation services. We would love the opportunity to earn your evaluation business.

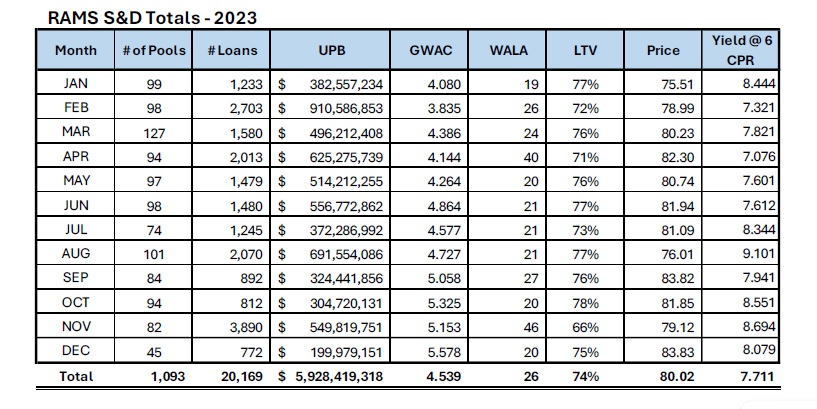

Scratch & Dent “S&D”

S&D volume declined by 22% in 2023 in line with the decline in mortgage origination volume. In 2023, we did see the WALA increase on pools bid and a higher percentage of loans trade as pricing went from the 70s to 80s as that market tightened. Even with this decrease in S&D volume, RAMS still marketed more than 1,000 pools for $5.9 billion to maintain its leadership role in this sector. Adjusting for specific loan characteristics, S&D pricing remained consistent throughout the year in terms of yield, and tightened in spread, as new buyers entered the market. The positive convexity return profile of deep discount mortgage loans remains an investor favorite, and in 2024, the typical S&D loan profile should continue to trade at discounts albeit with continuing high demand.

Jumbo

As rates rose and the banking crisis unfolded in Q1 of 2023, the bank portfolio selling we anticipated did not materialize. The Fed opened their emergency term funding program to Treasuries and MBS and provided liquidity, lending on underwater securities at par. This alleviated capital requirements and balance sheet pressures, which enabled most banks to hold underwater jumbo loans versus selling at discounts. While still facing liquidity constraints, in 2024, we have already marketed multiple (with more in the pipeline) portfolios from banks who are now prepared to sell at discounts to par. This is a trend that we see continuing throughout the year.

On the jumbo buy side, REITs and Wall Street aggregators emerged as the dominant liquidity providers in 2023 as this sector widened throughout the year. Jumbo spreads are typically a direct reflection of the health of bank portfolios and the lack of bank activity impacted the relationship between conforming and jumbo rates creating room for a securitization arb. We saw new jumbo production rates widen significantly versus agency rates in 2023. Given the overall superior credit quality of jumbo loans, this was a surprise dynamic that leaves jumbo looking cheap to agency loans on a risk adjusted basis, and when banks are able (or willing) to buy again, we expect this will be the first sector they look to for residential mortgage assets leading to a reversal of this trend and spread tightening in 2024.

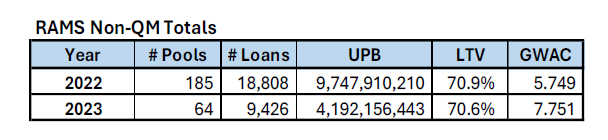

Non-QM & DSCR

Non-QM and DSCR loan sale volumes were hit hard in 2023 (see 2023 vs. 2022 comparison below). When the bank bid eroded in 2022, non-QM originators aggressively pursued long-term flow partnerships directly with end investors or transitioned into selling best eorts to aggregators for liquidity on generic product with securitization being the end result. This dynamic reduced loans available for bulk buyers which resulted in spread tightening in the sector as demand outpaced supply, a trend we expect to continue in 2024. RAMS specifically had success placing ITIN, Foreign National, and CDFI non-QM loans directly to end investors as replacement for generic bank statement, or DSCR, non-QM loans. As liquidity continues to come back into the loan space, we should see a reversal back towards originators increasing bulk sales to help mortgage originators obtain best execution and allow investors to aggregate enough volume in bulk for securitization.

Closed End Seconds “CES” & Home Equity Lines of Credit “HELOCs”

The second lien space was a bright spot in 2023 with new aggregators stepping in to fill the void left by banks and credit unions who left the space in 2022. We are seeing current production agency closed end second lien pools trading in the 105s (mid 8% yield at 15cpr) thanks to the securitization arb, and non-QM Second Liens trading 2-3 points lower. RAMS pool #112850 is the most recent example of an agency seconds pool that traded mid 105s servicing retained while RAMS pool #112843 is the most recent non-QM second lien pool that traded mid 103s released. We expect closed end seconds to be a 2024 bright spot for both originators and investors in terms of supply as more originators focus on the product. Hedging of second liens is more straight forward given the relatively shorter duration and with the deep investor pool, originators feel comfortable aggregating and selling in bulk transactions to obtain best-execution. This is a trend we expect to leak over into other credit sensitive, higher yielding, loan products like non-QM and bridge loans as liquidity comes back to the market and originators become more comfortable hedging in these sectors.

The HELOC market is historically dominated by banks and credit unions. With credit unions facing similar risk capital, balance sheet and deposit issues to their bank counterparts, the portfolio bid has yet to materialize. One 2023 bright spot for HELOCS is they can now be securitized thanks to a new structure that manages subsequent draws from the issuing trust administrator. Liquidity outside of the aggregators remains challenging especially for small pools or any loans not specifically originated.

GNMA EBOs

Our volume (in UPB) of GNMA EBO sales remained consistent at $3.3 billion in 2023 and in 2022, however, down from $7.8 billion in 2021 when EBOs traded at a premium. We are beginning 2024 with FHA EBO’s yielding mid 6% with VA and USDA EBOs trading wider in the low to mid 7% and expect volume in this sector to pick up in 2024. Pricing for 90-day delinquent FHA loans in Q4 2023 was approximately 1 to 1.5 points back of TBA plus refund of interest, escrow, and recoverable corporate advances. GNMA EBO sales volume is driven by a combination of (i) cumulative 60+ delinquency compared to maximum allowable GNMA levels, (ii) cost of carry for advances, especially in lower prepayment rate environments, and (iii) the re-delivery price for re-pooled loans. In general, 3% interest rate government loans were cheaper to retain in securities, but 6%+ interest rate government loans are good GNMA EBO targets and buyout should be evaluated.

In November 2023, the VA asked mortgage servicers to pause foreclosures for 6 months through May 31, 2024 and extended the COVID-19 Refund Modification Program. This action has left questions for the market and price discovery of VA EBOs has been limited as most EBO trades have involved FHA loans. This is interesting because pricing for newly originated FHA and VA loans was similar in Q4 2023. GNMA EBO Trades most often start with an evaluation, prior to buying subject loans out of agency MBS pools.

Bridge, Construction, Fix & Flip

In 2023, we saw aggregators within the bridge, construction, and fix & flip space exit the market making it advantageous for originators to align themselves directly with end buyers via vertical partnerships. The larger originators in these vertical partnerships are selling pass through rates in the 9.00% to 10.50% range. Smaller originators are selling the full coupon at par, or at slight discounts to par servicing released. With regional banks pulling back from portfolio lending in this space, we see an opportunity for outsized returns for investors who enable originators to maintain their

NPL

The NPL market continues to be active with a wide range of buyers who provide liquidity from a single DQ loan to larger NPL pools such as RAMS oering #112637 where we had 22 bids. We see fairly consistent pricing for NPLs with loss adjusted yields in the high single digits to low double digits depending on pool size, collateral characteristics, and geography. We ended 2023 seeing an increase in NPL loans out for bid with this trend continuing as we enter 2024.

As of late, especially on homes worth $1MM or more, we are seeing evictions continue to be a challenge. This issue is not unique to New York City or South Florida. We also have observed issues involving extended eviction situations in California, Illinois, New Jersey, Massachusetts, Connecticut, and Rhode Island. We anticipate deed in lieu of foreclosure or “cash for keys” will increasingly become the preferred resolution approach even though it is more expensive in the short term.

An observation worth noting is we’ve recently seen NY NPLs trading at lower prices due to a combination of factors including hard to project recovery timelines, higher carrying costs, and lower net recoveries. Moreover, the Foreclosure Abuse Prevention Act (“FAPA”) enacted in December 2022 added more uncertainty into the NY foreclosure process. The retroactive nature of this legislation is keeping NY courts from widely adopting this legislation and we are not aware of this impacting NY NPLs at the moment. There continues to be a select group of NY NPL buyers comfortable with the aforementioned property and legal related risks so while constrained, there is still liquidity for NY NPLs. The open question for the NPL market is will other states follow NY’s lead and enact similar laws to the detriment of NPL investors and housing prices.

We Thank You

2024 is shaping up to be an exciting year here at RAMS Mortgage Capital with new hires, and increased communication all to enhance capabilities, expand oerings, and better serve our existing and prospective clients. The most exciting new service added is our whole loan and mortgage servicing rights evaluation business. We have built a database from the literally millions of bids observed on the nearly 600 thousand loans we have marketed in the past several years, across every type of mortgage imaginable. The combination of our dataset and robust cash flow modeling and analytics sets us apart from other service providers because we can provide a true mark to market price. Couple this with a suite of custom reports and transparency of assumptions and variables and you will see why we are so excited about this new business.

To find out more please visit our website at (RAMS). Thank you for reading and we hope you have a great 2024.