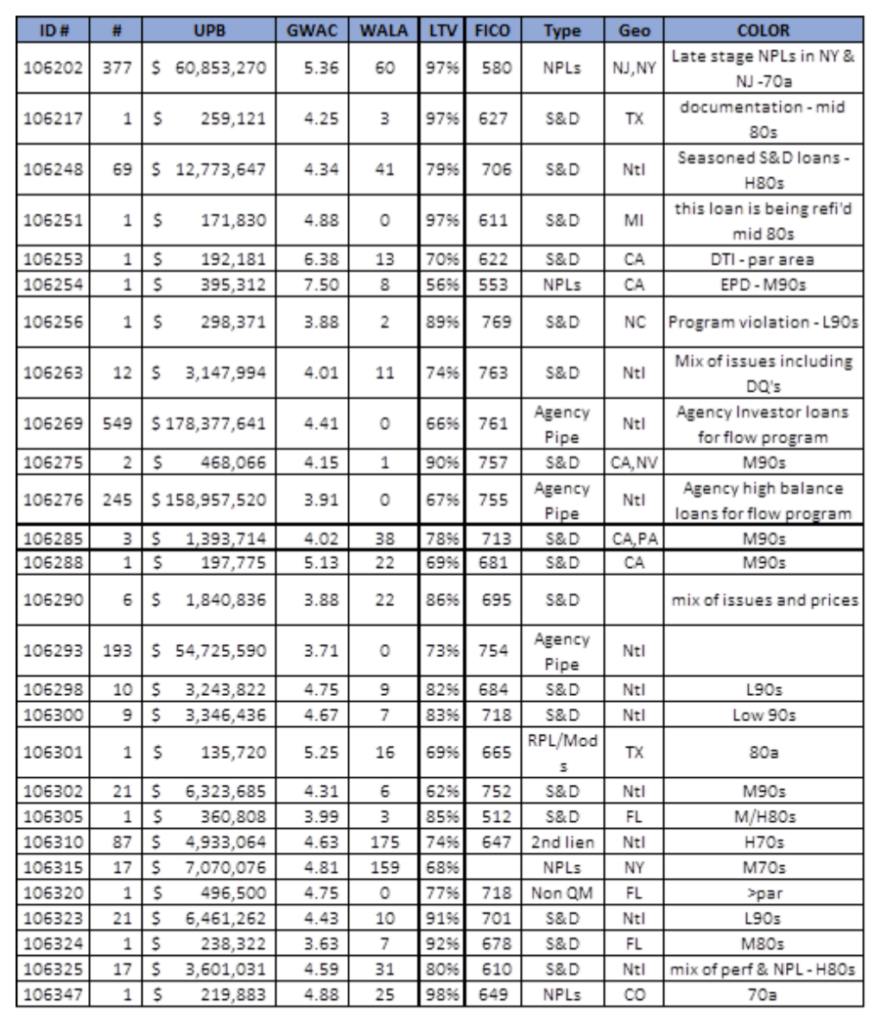

Everyone has heard by now the big news regarding servicing advance facilities and the agencies now accepting delivery of loans (excluding cash out refinances) with forbearance requests but at a large cost.

5% for first time home buyers and 7% for all other loans. This sets a mark for the industry relative to future trading in the secondary market. We saw price adjustments on trades involving loans with a recent forbearance request prior to the announcement impacted between 3% – 5%. We expect future trades to follow the agencies price guidance on loans with recent forbearance until there is evidence related to the migration of forbearance to either consistent payment or default. Not the best outcome for originations that will have more loans that are not agency eligible.

Recent reports indicate forbearance requests are running somewhere between 10% and 20% depending on the servicer. There are certainly borrowers in need of assistance, but there is likely some percentage

of borrowers who are “strategically” requesting and receiving forbearance even though they haven’t

been materially impacted by the shut down. Many servicers are anticipating a spike in requests this week as we approach month end.

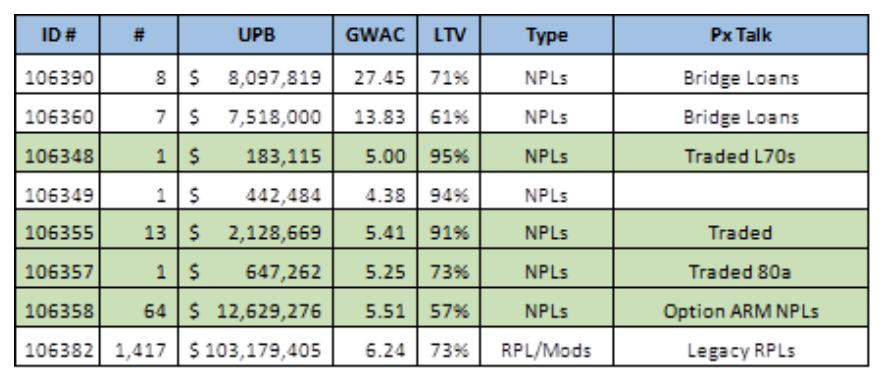

Any loan involving a forbearance plan will price lower, these loans will be viewed as riskier with a higher propensity to default. We won’t know for many months how these loans perform following the forbearance period. They could turn into spotty pays, modifications, re-performing, or non-performing loans. All these outcomes will result in losses to the originator or seller. With another 4 million American workers reporting for unemployment benefits this week, market participants are working to get a

handle on what forbearance means to the housing market, home values, and loss severity and default frequency assumptions.

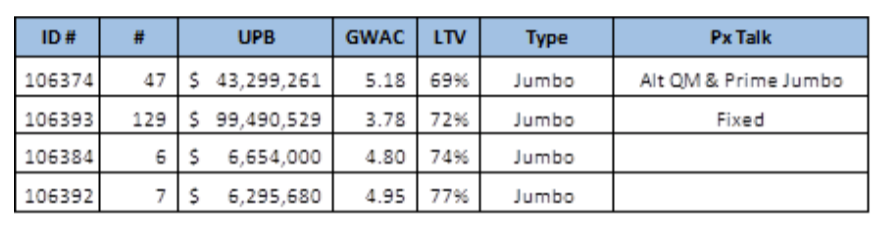

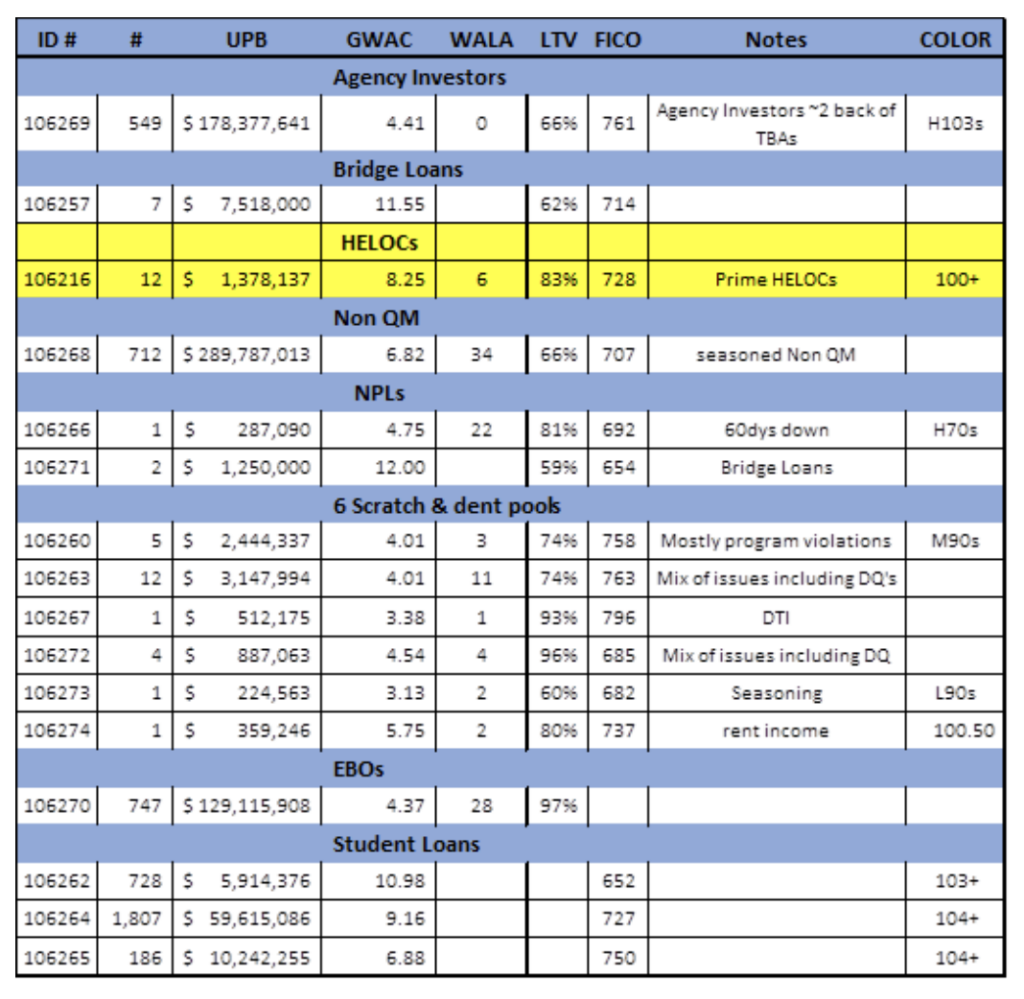

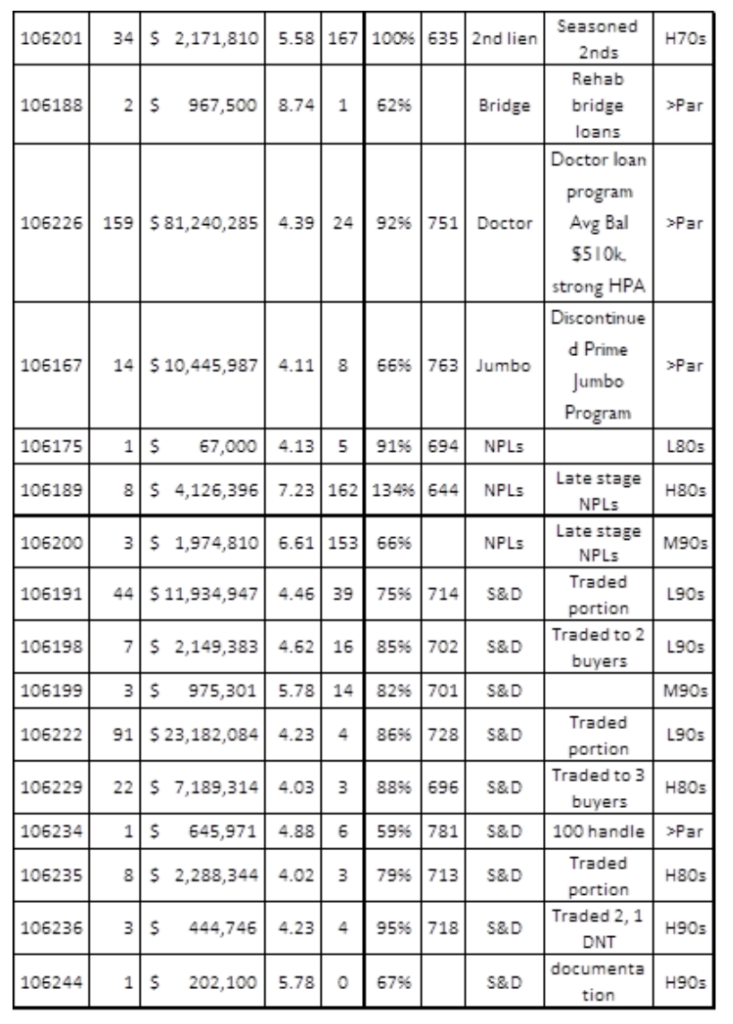

Jumbos

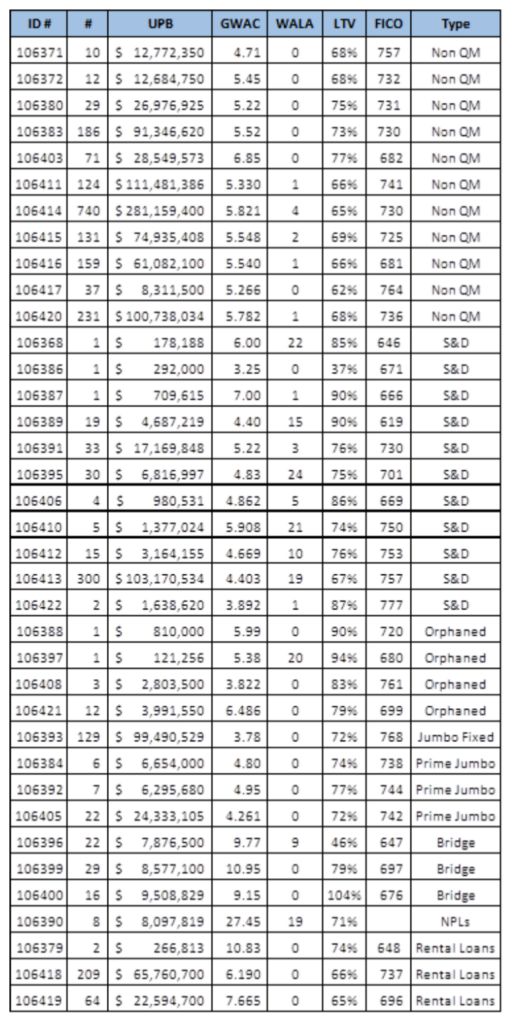

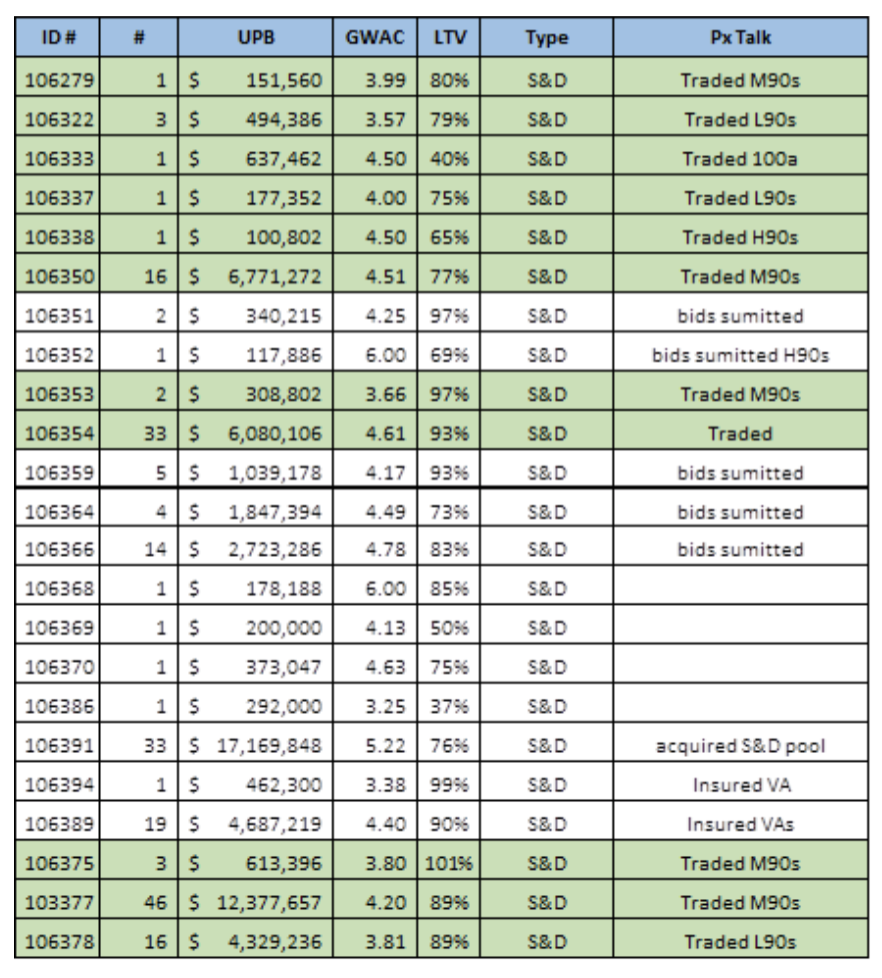

Jumbo loans saw both positives and negatives this week. Redwood declared it would not buy any loans in the current market. The good news is RAMS 106601 a pool with a 50% LTV and low coupons traded over par. Low LTV continues to be a driver for best pricing. We’re seeing a range of low to mid 90s for high quality jumbo loans. Scratch & Dent Supply continues to increase in this sector as warehouse lenders apply pressure to originators to remove these loans from their lines. With REITS and other levered investors leaving the market, there continues to be limited liquidity and downward pressure on pricing. Many sellers have been passing on current

levels, unwilling to accept the associated loss on sale, but product is trading. We executed 21 new trades this past week, 16 in this sector. We expect pricing to remain in the 80s for generic product. Risk adjusted yields are wider with buyers discounting prices in order to achieve a lower effective LTV (LTV multiplied by purchase price percentage). Our perspective continues to be to sell these loans before there is a forbearance request or payment event that will result in a lower price.

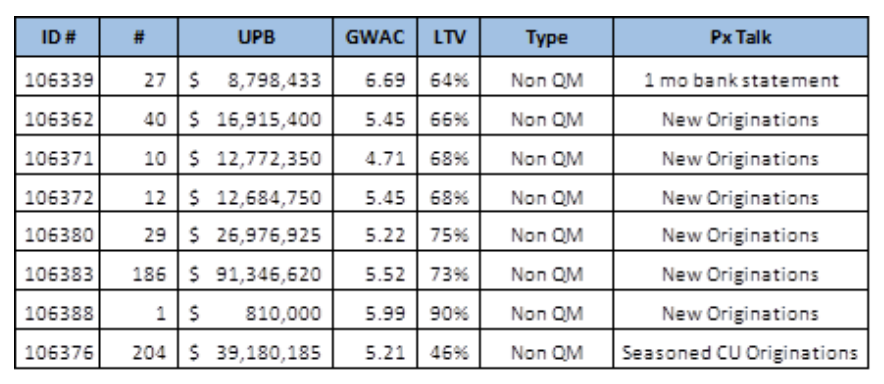

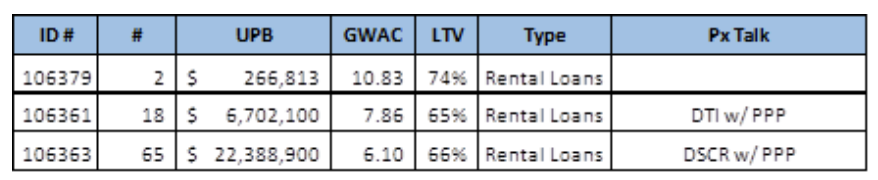

Non-QM

Last week ended with another forced $1BB liquidation out for bid. There was limited price movement in this sector last week as sellers continue to hold out for low to mid 90s in a mid to high 80s bid market. Regional warehouse lenders seem to be working with their clients to assist them in finding exits and

solutions for their orphaned production. Some monoline Non-QM originators are seeking hospital lines for 3 – 6 month timelines in an effort to survive, but large haircuts (we’re hearing ~35%) make this a difficult alternative. Sellers are hoping prices will improve though we’re not sure why or how in the near term. As we touched on last week, the credit stack has a very long way to go and the risks associated with forbearance, delinquencies, updated LTVs, unemployment, and a decline in the housing market, may not bode well for this strategy.

We continue to work hard to help our clients in this difficult time. Please provide color and feedback on what you’re seeing and we’ll continue to provide liquidity through our market participation and help any way we can. We appreciate your relationship and hope for the best for you and your family.