It’s late Q3 2023. Do you have a plan for valuing and managing your whole loan portfolio? As a sector, depositories are the largest non-government owners of MBS and mortgage whole loans, and higher interest rates have put most mortgages originated before 2022 at a market price discount. But this doesn’t mean that banks’ best course is to sit still until prices come back to par. Strategic repositioning out of some old low-rate loans and into new higher-yielding assets in 2023 can enhance year-end balance sheets and increase net interest margins in 2024 and beyond.

Institutions that want the option to make strategic reallocations before year-end should start the evaluation process now. The first step is a careful assessment of where loans trade in today’s market. RAMS, a leader in whole loan trading, is uniquely positioned to provide accurate pricing, state-of-the-art analytics, and market insight to bank portfolio managers.

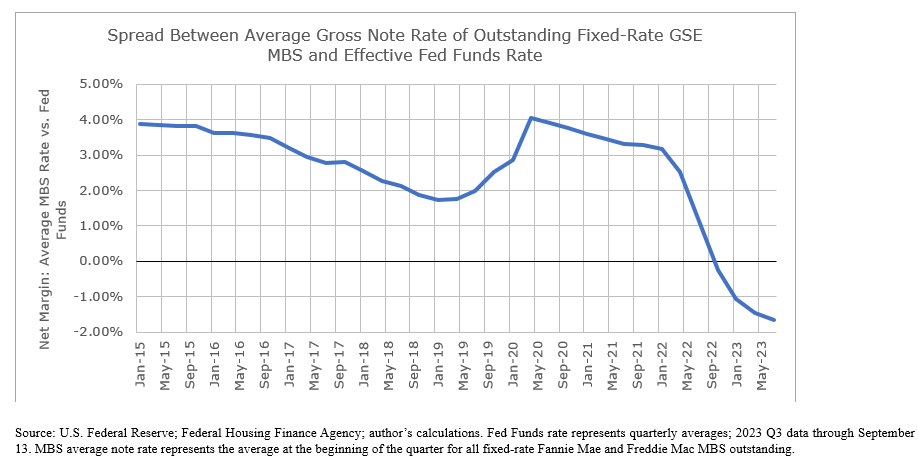

For banks, the problem goes beyond unrealized capital losses. Thanks to the Federal Reserve’s relentless increases in short-term rates, many institutions now face weak or negative net interest income on their mortgage loan portfolios. The pressures on interest margins are illustrated by the chart below, which tracks the spread between the average gross note rate of outstanding loans in GSE (Fannie and Freddie) fixed-rate MBS and the effective Fed Funds rate from 2015 to through 2023 Q3.

Source: U.S. Federal Reserve; Federal Housing Finance Agency; author’s calculations. Fed Funds rate represents quarterly averages; 2023 Q3 data through September 13. MBS average note rate represents the average at the beginning of the quarter for all fixed-rate Fannie Mae and Freddie Mac MBS outstanding.

As the chart shows, the average mortgage rate-Fed Funds spread has fallen by a stunning 500 bps over the past two years. This is the crux of the problem for banks’ net interest margins. While the tightening cycle may be near its end, it’s quite possible that the Fed will hold short rates at their current high levels for an extended period to wring inflation out of the system. That would subject owners of low-rate mortgage loans to years of weak net interest margins, before seeing real improvement.

For banks, the trade-off in any sale of underwater assets is taking short-term pain to achieve longer-term gains. The pain: a realized loss. The gains: improved future net interest margins and a balance sheet that shows fewer unrealized losses.

The equity market is painfully aware of this issue and can see the size of the unrealized losses. Every institution’s situation is unique. But with so many bank stocks trading poorly, it can be argued that this is precisely the time to attack the problem and begin the cleanup process. Looking ahead equity investors may look for improvements in net interest margin as a key marker of superior performance. In addition, demonstrating the ability to move or reduce the loan portfolio may allay concerns about shrinking deposits.

Strategic sales of low-rate loans to reposition into higher-yielding assets can launch a bank toward higher future net interest margin. The first step in this process is an accurate portfolio valuation assessment, which should provide the following information:

• Real-time, loan-level market prices that accurately pinpoint where assets trade today.

• Risk assessments, with particular focus on interest rate risk (duration and convexity).

• Principal runoff projections.

This evaluation helps banks achieve two objectives:

• Assess where they can achieve the best bang for the buck – gain-to-pain ratio – via portfolio reallocations in 2023.

• For loans that don’t currently make sense to sell, establish a future action plan to implement when market levels make their sale more attractive.

Liquidity in the whole loan space is strong, right now. The market’s not frozen; the shock of higher rates has worn off, and a wide range of assets trade regularly in well-defined price corridors. That said, it’s rarely good to be a “before year-end” seller in the last few weeks of the year. Now is the time for banks who want the option to reallocate assets in 2023 to begin the strategic evaluation process. Don’t wait till Thanksgiving.

With mortgage rates high and production supply down if you have needs for CRA eligible loans for lending credit you don’t want to wait till Thanksgiving either. RAMS has a national pipeline of CRA eligible in the billions every day. Please let us know if we can help you in your search for these low to moderate income mortgage loans.

RAMS Mortgage Capital is a mortgage trading business that provides financial institutions and investors with solutions to increase revenue and profitability while managing risk and volatility. RAMS is one of the most active loan broker-dealers in the country, trading the full spectrum of loan products. Whether you have a single loan or a multibillion-dollar pool, RAMS will ensure the best execution from bid to settlement.

Please contact us to discuss greater detail.

Thank you.