We’re buried trying to get the number of offerings out and can only imagine what it must look like on. the receiving side of these emails, so we apologize and we’ll try to summarize below.

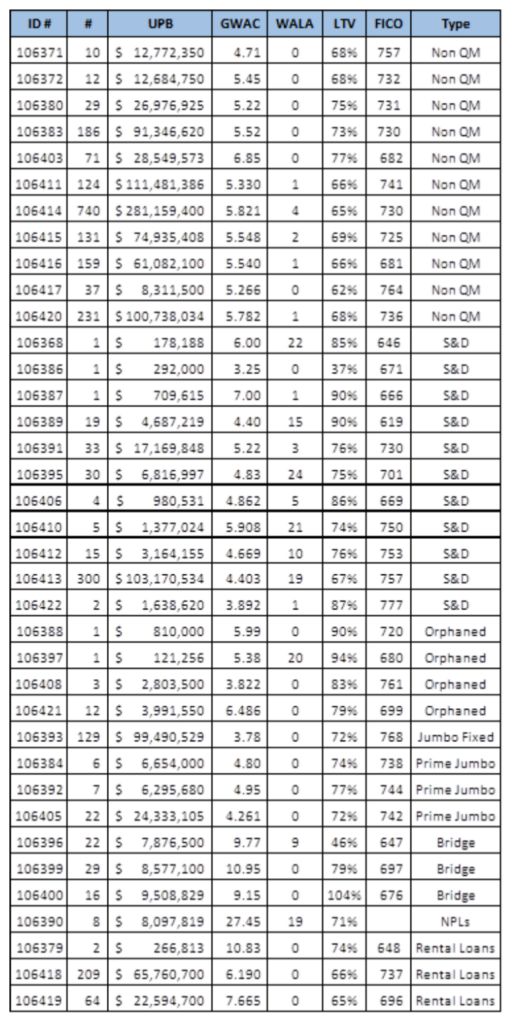

Non QM – 15 pools ~$820mm

This sector is getting a lot of attention but struggling to find a clearing level. We’re battling “1 st in fear” and alternative investments. Anybody see airplane lease spreads? We’ve heard lots of rumors

but we can only confirm what we’ve been involved with. 106376 $39mm seasoned 5.208 GWAC, yesterday, traded at 95.00. FYI, this was offered in the

80s two days ago. We have traded a few single orphaned loans the low/mid 90s as well as, low LTV geographic specific pools to banks in low 90s to 90 area. We are currently working on similar targeted subsets. Also in talks with a number of larger investors that could clear some of this product in size.

Scratch & Dent and orphaned loans – 18+ pools $150+mm Newly originated, brand new loans with minor issues. We will send out a single offering this

morning with all the current inventory in an attempt to create a single file to view. Several participants here have suspended bidding and some of the previous buyers have become sellers. We traded 3 pools yesterday and pricing is off ~10%.

Jumbo Prime and Alt A Loans – 4 pools ~$136mm Bank quality fixed and ARM loans. A large portion of 106393 looks to be trading today, close to

par.

Bridge and Fix & Flip – 3 pools ~$26mm Short term rehab loans with ~10% GWAC. Market was trading retained in a range with 7.5% pass thru at par being the average. We saw bids yesterday in the 90 area and all sellers passed, given the short duration. Sellers would trade at par released.

NPLs 2 pools ~$20mm Foreclosure timelines have extended and values will undoubtedly be lower when we get through this but that’s the same for both the buyer and seller. Slight premium for this market. Saw high

80s on 106358 that seller needed low mid 90s. Seeing 70 area (probably trades today) for 106390 which is in line with where NPLs traded before we saw leverage come into the sector.

Rental Loans 60 to 70 percent LTVs, underwritten to renter cash flows, personal guarantees, double digit default coupons with prepay penalties. These were trading north of 105. Would love to hear why these

6 and 7% coupons aren’t clearing in the 90s.

Just trying to quickly some get color out to all.

Please let us know what you’re doing and stay healthy!

List of offerings