Where are we in whole loan land? Where are we going?

We can answer the first question – Prices are lower, yields are trending higher, and liquidity comes at a premium. The second question generates more questions than answers.

TBA prices have dropped more than ten points since the beginning of the year however non-TBA eligible loans execute into a much less liquid market.

Financing costs have gone up (if financing is available at all) and another Fed interest rate hike is coming next week with an expected raise of at least 75 basis points. The Fed is in the midst of its quantitative tightening plan and 09.14.22 was the last day of MBS purchasing by the Fed. This coupled with out of the money coupons is driving scratch & dent prices lower. We know these lower coupon putbacks from the agencies will continue well into next year but where are scratch & dent prices now?

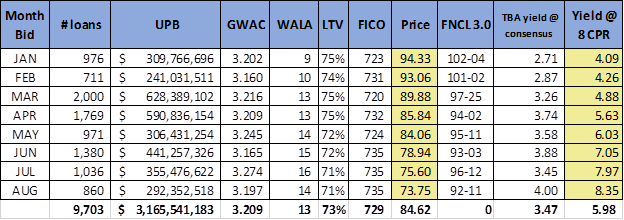

From January to August 2022, we have marketed over 1,250 pools with an aggregate UPB around $5.5BB. The bulk of these pools contained loans originally destined for agency execution, so the loan characteristics are similar to collateral in the TBA market: Low 700s FICO, Low 70s LTVs, and Low/Mid 40s DTI’s. Coupons ranged from mid 1’s% to 9% and prices from high 50s to 102+. To track pricing, we compressed our subset to include only pools with coupons between 2.75% and 3.50%. For this subset, there were 589 pools with a UPB of $3.2BB and a 3.209 GWAC. Please see Table 1 below for a comparison of average price for S&D vs. FNCL 3.0 TBAs, along with their corresponding yield at dealer consensus prepayment speeds, as well as the whole loan equivalent yield at an 8 CPR.

Table 1

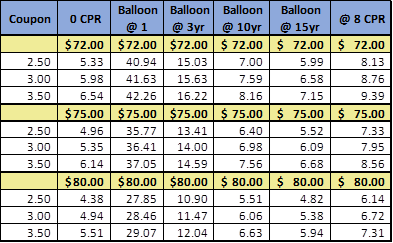

Discount rate is the most sensitive pricing variable for these out of the money coupons. This is followed by prepayment speed, where a lower prepayment speed not only lowers price, but also extends duration to a level viewed as unattractive by many institutional investors. We have heard of bidders using a zero CPR for the lowest coupons. Do you know of anyone that has ever made a 360th payment? Life happens, and loans payoff for lots of reasons unrelated to interest rates.

Table 2 below reflects the yield at different coupons using a zero CPR and balloon prepay at the end of years 1, 3, 10, and 15.

Table 2

We believe owning performing mortgages at 20+ point discounts to par is a solid strategy if you have patient capital.

RAMS is here to help firms get through these turbulent times.

We have marketed more than $200BB in REOs, NPLs, RPLs, agency eligible, scratch & dent and specialty loans. With all the pricing data gathered from trading, we are expanding our evaluation services! We are currently evaluating billions in UPB every week for clients including warehouse banks, hedge funds, accounting firms, banks, and most recently, originators choosing to hold loans requiring a mark for their annual audit. Let’s set up a call to discuss your evaluation requirements.

“In a time of turbulence and change, it is more true than ever that knowledge is power.” JFK